Industry

Industrial flexibility as an enabler of the energy transition

CO₂ avoidance with existing assets from the industry and simultaneous profit realisation are possible with the help of our intraday flexibility marketing.

START  Flexibility marketing in the industry

Flexibility marketing in the industry

The expansion of renewables not only brings volatility to power generation, but also to the power exchange. In the event of oversupply, e.g. bright breeze, Bright breeze refers to the availability of large amounts of electrical energy from renewable generation due to a lot of wind and a lot of sun Dark lull refers in the energy industry to the low availability of electrical energy from wind and PV generation due to darkness and little wind Dunkelflaute bezeichnet in der Energiewirtschaft die geringe Verfügbarkeit elektrischer Energie aus Wind- und PV-Erzeugung aufgrund von Dunkelheit und wenig Wind they increase. Existing flexibility potential, particularly in industry, can help to close these gaps.

Wir handeln mithilfe unserer algorithmusbasierten Flexibilitätsvermarktung industrielle Verbrauchs- und Erzeugungsflexibilitäten gleichermaßen am Strommarkt. Das hilft der Integration der renewables and saves CO₂. At the same time, companies can generate additional profits of up to €185,000 per MW and trading direction per year by adjusting consumption and/or generation to market behaviour.

The power exchange is increasingly gaining in volatility and volume as more and more renewables are fed into the grid. Regardless of crises and impending energy shortages, we can therefore expect wider price spreads in the continuous intraday of the power exchange and thus the value of flexibility is also increasing.

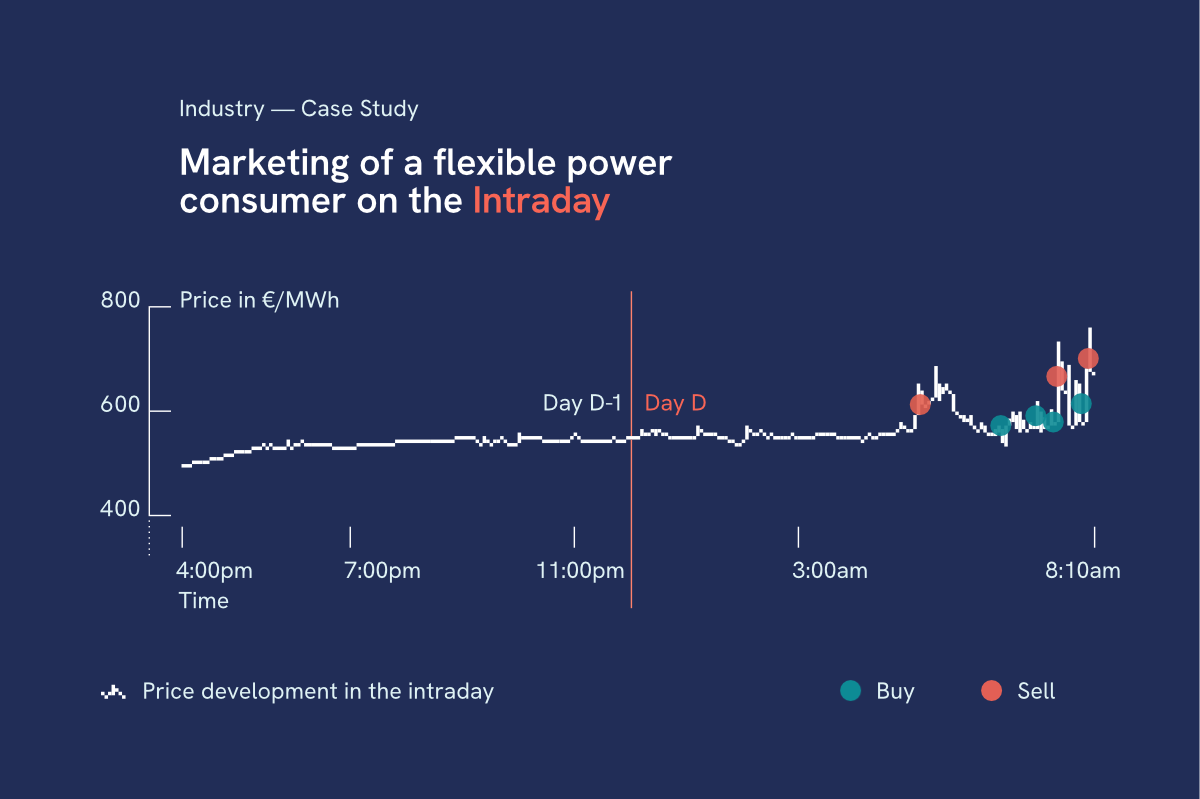

Case study: Production power flexibility

For example, an industrial customer regularly notifies us of 6 MW of flexibility for its production plant in both trading directions for certain quarter-hourly products on the intraday market. This was also the case on day D for 8:15-8:30 a.m. Our individualised algorithms then traded the 6 MW on the electricity exchange's intraday market from 4 p.m. on the day of the presentation (day D-1) within the plant-specific restrictions. During this period, over 30 trading transactions were traded up to gate closure for a single product of this type. In the end, the customer did not have to shut down his plant on this day Typically, actual physical fulfilment only occurs in 30% in our portfolio average of all clients. but was only able to reduce its energy costs by around € 225 in this quarter of an hour through trading transactions. At the same time, this system has made an active contribution to grid stability and indirect CO₂ savings.

About us

RETHINK ENERGY. RESHAPE ECONOMY.

The diversity of the energy sources available today leads to so far unseen volatility. We react to temporary changes within fractions of seconds – with our customised offer according to customer specifications.

Know-how

Our participations in a digitally characterised world

With our solutions, we consistently rely on digital applications. This is bearing in mind that fractions of seconds in the interaction between supply and demand decide on financial success, incurred costs, and long-term supply reliability.

As specific as your need:

Our answer

We are specialised in developing solutions customised to your personal requirements. And you can also righty expect this based on the information you receive from us.

We are happy to advise you

Christian Irion | Senior Sales Manager

+49.201.22038-143

christian.irion@esforin.com

ESFORIN SE

+49.201.22038-100

info@esforin.com

Ruhrallee 201 | 45136 Essen